Attention small business owners, it’s not too early to be thinking about tax deductions. Have you bought or financed any new or used equipment for your business in 2022? Do you plan on adding to your business fleet before the end of the year? Section 179 of the U.S. internal revenue code will allow you to deduct the total purchase price of depreciable business equipment from your gross income.

Section 179 Explained

In the past, if you bought equipment for your business, you would typically write it off on taxes a little bit at a time through depreciation. Section 179 allows businesses to write off the total purchase price of new and used qualified equipment for the current tax year.

However, what can be written off has limits, and there are limits to the cost of the purchased equipment. Also, remember that the equipment needs to be put into service before midnight on December 31, 2022, to qualify.

Thoughts from our Vice president

Nick Ferree, the Vice President of Equipment Source Inc., had this to say about Section 179

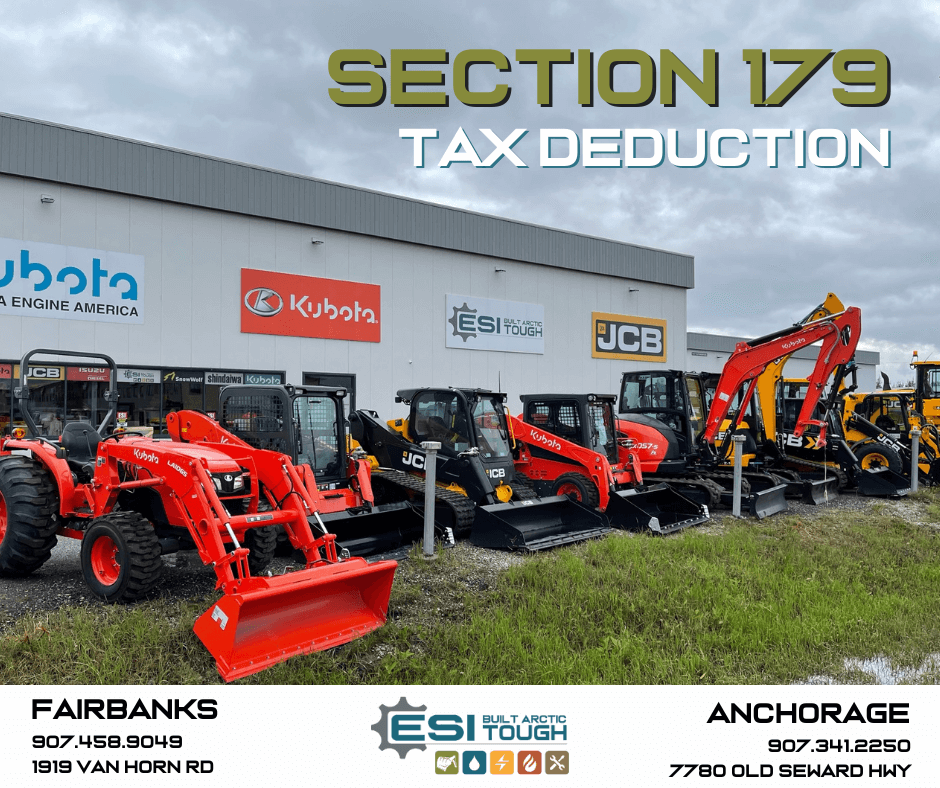

“We have Alaska-made ESI and also JCB equipment ready to purchase in Fairbanks and Anchorage. We also have clinical-grade air purifiers that are a necessary piece of workplace equipment. Our highly qualified sales team is ready to help you find the equipment that will fit your business needs.”

Contact us: Let our sales team help you find the right equipment to add to your fleet before the end of the year.

Utilize Tax Deduction Calculator

Section 179 could be highly profitable to your business, and it’s in your business’s best interest to learn as much as possible. Check out the Tax Deduction Calculator on Section179.org to get an estimate of how much money you could save.

learn more

Act now, and don’t lose out on your savings. Section 179 can change each year without notice and sometimes even change mid-year. Learn more about how Section 179 can help your small business by visiting www.Section179.org.

***Disclaimer***A professional advisor should be consulted before implementing any of the options presented. No content should be construed as legal or tax advice. Always consult with an attorney or tax professional regarding your specific legal or tax situation.